RESNET

SmartHome Newsletter

Get all the latest news on home energy efficiency!

Energy Efficient Home Tax Credits & Mortgages

Home renovation can be an expensive venture. However, when you decide to incorporate energy saving features that transform your standard house into an energy efficient home, your renovation project could be much more affordable than you think.

Many homeowners may not be aware of the significant financial incentives being offered by federal, state and municipal governments to help them make their homes more energy efficient. Among the resources available are:

1. Personal Tax Credits

The federal government provides homeowners with personal tax credits they can use towards financing energy efficient retrofits to their homes.

a. Residential Energy Efficiency Tax Credit

This tax credit was retroactively renewed until December 2013, meaning that any qualified equipment, installed in 2012 or 2013, is eligible for this credit. This personal tax credit can be used towards energy efficient technologies such as:

- Water heaters

- Furnaces

- Boilers

- Heat pumps

- Central air conditioners

- Building insulation

- Windows

- Roofs

- Circulating fans used in a qualifying furnace

b. Residential Renewable Energy Tax Credit

The Residential Renewable Energy Tax Credit (for residential energy property) was originally applicable for solar-electric systems, solar water heating systems and fuel cells. However, through the Energy Improvement and Extension Act of 2008, the tax credit was extended to include small wind-energy systems and geothermal heat pumps as well. Eligible renewable (and other) technologies include:

- Solar Water Heat

- Photovoltaics

- Wind

- Fuel Cells

- Geothermal Heat Pumps

- Other Solar-Electric Technologies

- Fuel Cells using Renewable Fuels

2. Energy Mortgages

a. Energy Efficient Mortgage

An energy efficient mortgage enables homebuyers to finance and include cost-effective energy saving measures as part of their mortgage. They are used towards purchasing a new home that is already deemed an energy efficient home, and allow borrowers to qualify for larger loans to upgrade to more energy efficient homes. Homebuyers must first get an energy rating on the home in order to qualify for an energy efficient mortgage.

b. Energy Improvement Mortgage

Energy improvement mortgages are targeted towards homeowners planning on making energy efficiency improvements to their existing homes. The costs for these improvements are accounted for in the mortgage so borrowers aren’t confronted with the prospect of a larger down payment. Qualification for an energy improvement mortgage also requires an energy rating.

3. State Financial Incentives

Many states offer a number of financial incentives that encourage homeowners to live in an energy efficient home. Some examples include:

- Local rebate programs

- Performance-based incentives

- Personal tax credits

- Utility rebate programs

- Utility loan programs

The Database of State Incentives for Renewables & Efficiency offers a complete state-by-state list of available incentives and programs.

An energy efficient home provides its owners with so many benefits, like increased home comfort, lower utility bills, and a better quality of life to name but a few, that it’s no wonder that more and more Americans are opting for energy retrofits. And with the help of federal, state and municipal governments, energy efficient renovations are now more affordable than ever. So if you’re considering a home renovation project, do it the smart way – go energy efficient!

Looking for more information?

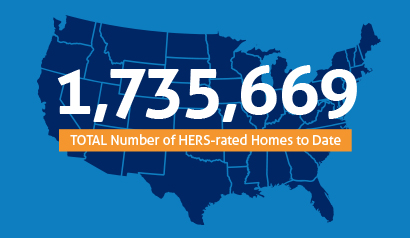

2 Million HERS Rated Homes Infographic

See how and why over 2 million homes have been HERS rated to date, saving energy and money for homeowners across the country!

»Read More Views:

RESNET Annual Report 2015

RESNET's 2015 Annual Report is out! Check out our scorecard for the year - all we'll say for now is that it's been a great...

»Read More Views:

Common Home Winter Problems to Avoid – Infographic

Harsh weather can cause all sorts of home winter problems for your home. This infographic shows you some of the more common...

»Read More Views: